Cashflow management is one of the most important aspects of running a business, it can quite literally be the difference between a successful business and struggling business. If I had to give one piece of advice to every business owner I meet, it would be this: cash is king. Not profit, not revenue, not growth just cash. I am talking with experience, as a broker I have dealt with over 2000 businesses.

I once met a business owner, let’s call him Dave, who ran a small manufacturing company. On paper, he was killing it, he was profitable, growing, and winning new clients every month. But every Friday, he was scrambling to pay staff and suppliers. “I don’t get it,” he told me. “I’m profitable, but somehow I never have enough cash.”

Sound familiar? You’re not alone. Profit is what your business earns, but cashflow is what actually keeps your doors open. And here’s the truth: many businesses fail not because they’re unprofitable, but because they run out of cash.

I’ve seen it happen countless times.

Through this blog, I want to dig deep into why cashflow matters, the red flags to watch for, and how you can get ahead of potential problems before they spiral.

Profit vs Cashflow: Why This Confuses So Many Business Owners

Here’s the thing: just because your business is profitable doesn’t mean you have cash to spend. Profit is what’s left on paper after you subtract expenses from income. Cashflow is the money actually moving in and out of your account.

If I was to give a simple analogy profit is like your school report card, it tells you how you are doing overall. Cashflow on the other hand, is like oxygen without it your business can’t breathe.

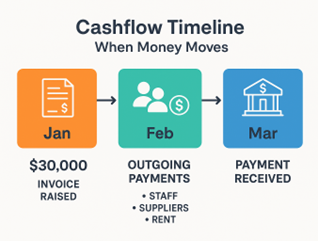

A recent example that comes to my mind is from a client named Sarah. She owns a boutique marketing agency, and she signed a $30,000 client contract in January, but her payment terms were 60 days. Her books showed $30,000 in income, but her team still had to be paid fortnightly. That lag is where cashflow problems hide. Profit says she’s winning; cashflow says she’s barely scraping by.

Similarly, let’s say you run a small manufacturing business. In June, you deliver $80,000 worth of orders. Your books show a $30,000 profit net of all expenses for that month. Feels great, right? But 70% of your clients pay you 30 days later. However, in that duration you still have to pay rent, wages, and suppliers. Suddenly, that $30,000 profit doesn’t help much, you might even need to dip into credit to stay afloat.

This disconnect is why many businesses get caught off guard. Cashflow is the reality; profit is the theory.

Spotting the Red Flags Early

You don’t need to wait for a full-blown crisis to notice trouble. Here are some signs your cashflow might be under pressure:

- Late supplier payments: If you’re constantly negotiating extensions or juggling who gets paid first, that’s a warning.

- Over-reliance on credit: Using your credit card or overdraft as a daily “patch” is risky.

- Long debtor days: Clients taking longer than agreed to pay adds hidden strain.

- No buffer: If one unexpected expense could derail your cash position, you’re exposed.

These aren’t just numbers on a statement; they’re signals that your business might be living hand-to-mouth.

Practical Steps to Keep Your Cashflow Healthy

I’m going to skip generic advice like “track your cashflow” and give you things you can actually act on.

- Forecast but make it real

Many business owners do a forecast once a year and forget about it. A useful forecast is dynamic. Track expected cash inflows and outflows weekly or monthly and update it when something changes. You’ll spot shortfalls before they hit.

I worked with a small e-commerce business that was constantly overdrafting. By building a rolling 3-month forecast, breaking invoices into milestones, and adding a small cash buffer, they went from weekly panic mode to planning mode. They could anticipate slow months, schedule inventory purchases properly, and even explore small growth opportunities they never thought possible.

- Invoice like a boss

Don’t wait for clients to pay you. Send invoices immediately, follow up consistently, and if possible, incentivize early payments. Even a small 2% discount for early payment can make a huge difference. - Match your spending to your income

If you know a big chunk of cash won’t arrive until the 15th, don’t schedule a supplier payment for the 10th. Align your outgoings with when money actually hits your account.

- Build a buffer

Think of it as a rainy-day fund for your business. Even $5,000 – $10,000 can give you breathing room when something unexpected happens. - Review your client mix

I’ve seen businesses crushed by over-reliance on one or two big clients. Diversify so one late-paying client doesn’t knock you off your feet.

When to Bring in Help

The concepts of cashflow are very simple in nature, there is no complicated formula that you need to memorise; however, it can be tricky and it’s not always intuitive. If you’re constantly juggling payments, struggling to forecast, or relying heavily on credit to survive, it’s time to talk to someone who can help. Sometimes just having an outside perspective can uncover simple fixes that make a huge difference.

Another interesting story: The Glass Glazing Company

Our example involves a glass glazing company in Metro Melbourne that skyrocketed from zero revenue to seven figures within a few years. This success was driven by the business owner and his son, who had over 40 years of combined experience and handled all the sales. Despite their busy schedule and profitability, cash flow remained tight.

In their second year, news broke that one of their biggest clients was going bust, putting all owed payments in jeopardy. When their client eventually went under, the once profitable business began defaulting on its loan repayments and supplier payments. Sadly, the business folded in its third year.

From inception until their major client’s collapse, the business appeared highly profitable on paper, but reality painted a different picture. It’s crucial to distinguish between profit and cash flow. This is where we come in, we help small business owners make smart decisions.

Closing Thought

Cashflow management isn’t glamorous, but it’s the foundation of a sustainable business. By paying attention to the real movement of money that comes in and goes out, forecasting realistically, and building small buffers, you give yourself options, not stress.

It’s not about how much you earn; it’s about how much is available when you need it. A little planning today can save a lot of headaches tomorrow. Remember Dave and Sarah? Both are thriving now, not because they made more profit, but because they understand the rhythm of their cashflow.

Take action today

If your cashflow feels unpredictable, take a few minutes this week to map it out. Or, if you want a guided approach, we can help you build a realistic cashflow plan tailored to your business.